Editorial

Front Page - Friday, January 21, 2011

The Bookworm

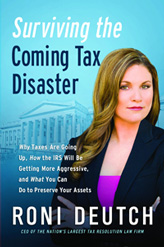

“Surviving the Coming Tax Disaster”

Terri Schlichenmeyer

There are, as they say, two things you can’t escape: death and taxes.

You try to avoid both as much as possible. The former is so distressing, so intimidating. It’s the ‘Great Unknown,’ a hidden surprise that could be painfully unpleasant, and that’s just frightening.

Come to think of it, that very well describes the latter, too.

You’ll never elude death, but you may escape the taxman, according to Roni Deutch. In her new book “Surviving the Coming Tax Disaster,” she tells you how to survive April 15, the IRS, and a visit from your favorite uncle.

Although nobody likes to pay taxes, we know that civilization would cease without them. We wouldn’t have roads, police protection, public libraries, or any of the hundreds of things we enjoy. Life truly is easier, thanks to our taxes.

Which doesn’t make them any easier to pay, but...

But what if you can’t pay? What if you lost your house in foreclosure or disaster, closed your business, had quintuplets, got divorced, widowed, hurt, killed, or were otherwise pockets-inside-out broke?

Don’t expect the IRS to care, says Deutch. Times are tough, and the government will do everything to get their money, even if you don’t have anything to give. They can – and will - take your paycheck, car, home, savings, business, and they can ruin your credit for a long, long time if you don’t comply. So what can you do, particularly if you get an ominous letter from your favorite uncle?

First of all, says Deutch, don’t put the letter in the drawer and sprinkle fairy dust on it. The IRS won’t just go away, and they’re perfectly willing to ramp up the pressure. Time is of the essence in this situation. Don’t waste any.

Understand that a tax professional is worth more than his or her weight in proverbial gold and that person may mean the difference between keeping your assets and losing them. If you’re self-employed, don’t ever hide anything – like Santa Claus, the IRS knows when you’ve been bad. Know your options – Uncle Sam does offer some - and (did we say this?) consult a tax professional.

Finally, take tax-paying seriously. You can bet the IRS does.

Are you addicted to thrillers? You’ll throw rocks at those fake-scary things when you read this book. Seriously, “Surviving the Coming Tax Disaster” is the stuff nightmares are made of.

Author Roni “The Tax Lady” Deutsch doesn’t beat around the bush. She’s matter-of-fact here, explaining how the economy got to this point, why the government is doing more audits, and why the IRS is so aggressive in getting its money. But she also offers lots of ideas on how to lower your tax bill, and what to do and not to do when it comes to paying what you owe the government.

Even if you’re meticulous about your taxes, you’re still going to want to spend an evening or two with this sobering book. What you learn in “Surviving the Coming Tax Disaster” might still scare you to death.

The Bookworm is Terri Schli-chenmeyer. Terri has been reading since she was three years old and she never goes anywhere without a book. She lives on a hill in Wisconsin with two dogs and 12,000 books.

|

|